How SIM Swap Impacts SMS Verification

SIM swap fraud is one of the biggest threats to SMS verification today. Criminals trick mobile carriers into transferring your phone number to their SIM card, giving them access to sensitive information like two-factor authentication (2FA) codes. This can lead to stolen money, hacked accounts, and identity theft.

Here’s the problem: SMS verification assumes your phone number is secure, but SIM swaps exploit this vulnerability. Financial losses from these attacks are staggering – $68 million in 2021 alone, according to the FBI.

Key Insights:

- What Happens in a SIM Swap? Attackers intercept SMS messages, including OTPs, by taking control of your phone number.

- Why It’s Dangerous: They can access bank accounts, reset passwords, and steal cryptocurrencies.

- Stats to Know: SIM swap fraud cases rose by over 1,000% in the UK between 2023 and 2024.

- Better Security Options: Use authenticator apps, hardware security keys, or biometric verification instead of SMS-based 2FA.

Quick Tip: Protect yourself by setting a SIM PIN, enabling number transfer protection with your carrier, and avoiding SMS for critical account security.

SIM Swapping: How Hackers Take Over Your Phone

SIM Swap Fraud Basics

SIM swap fraud is a form of identity theft where criminals manipulate mobile carriers to seize control of a victim’s phone number. This tactic not only compromises personal security but also puts financial assets at risk by enabling unauthorized transfers.

SIM Swap Attack Methods

Fraudsters use various techniques to gather personal information about their targets:

| Information Source | Collection Method |

|---|---|

| Phishing Campaigns | Fake emails or texts tricking victims into sharing details |

| Social Engineering | Convincing individuals to disclose sensitive information |

| Data Breaches | Purchasing stolen data from illicit sources |

| Social Media | Extracting details from publicly available profiles |

Once they’ve gathered enough information, attackers pose as the account holder and request a new SIM card from the mobile carrier. In some cases, they even bribe carrier employees to expedite the process [3]. This strategy grants them control over the victim’s phone number, which opens the door to further breaches.

"SIM swapping happens when scammers contact your mobile phone’s carrier and trick them into activating a SIM card that the fraudsters have. Once this occurs, the scammers have control over your phone number. Anyone calling or texting this number will contact the scammers’ device, not your smartphone." [5] – Norton

Why Attackers Choose SIM Swaps

The appeal of SIM swapping lies in the access and control it provides. Here’s why it’s a favored method among fraudsters:

- Financial Exploitation: Gaining access to banking apps and cryptocurrency wallets that rely on SMS for verification.

- Account Takeovers: Resetting passwords to seize control of email, social media, and other accounts.

- Bypassing Authentication: Intercepting one-time passwords (OTPs) and two-factor authentication codes.

The impact of these attacks is evident in real-world cases. In 2024, a Bank of America customer was defrauded of $38,000 after falling prey to a SIM swap scam [7]. In another instance, a victim lost $17,000 when fraudsters locked her out of both her phone and banking accounts [7].

"Many frauds are just a case of a single loss of money. When you lose your identity, it has an enduring long-term impact. SIM swap fraud points to the growing sophistication of frauds and gives them ever more control over our daily lives." [8] – Simon Miller, Director of Policy, Strategy and Communications at CIFAS

The increasing popularity of cryptocurrencies has made SIM swapping even more lucrative for criminals. Since crypto transactions are irreversible and digital assets often hold significant value, fraudsters see an opportunity to maximize their gains while minimizing the chances of being caught [9].

SMS Verification Weaknesses During SIM Swaps

How Attackers Steal OTP Codes

When attackers pull off a SIM swap, they gain full access to all SMS messages sent to the victim’s phone number. Because SMS messages are transmitted in plain text, any one-time passwords (OTPs) sent this way are immediately exposed [6].

Here’s how the attack typically unfolds:

| Attack Stage | Method | Impact |

|---|---|---|

| Service Disruption | Victim loses cellular service | A clear sign that something is wrong |

| Message Interception | SMS traffic is redirected to attacker | Verification codes become accessible |

| Account Access | OTPs bypass two-factor authentication | Quick access to multiple accounts |

| Delayed Discovery | Number returned to victim’s SIM card | Victim often stays unaware of the breach |

But the problem doesn’t stop at stolen OTPs. SIM swap attacks open the door to much larger security issues, putting entire account ecosystems at risk.

"When a bad actor has your phone number, they can bypass two-factor authentication and access your bank accounts or open new ones in your name." – Eder Ribeiro, Senior Cybersecurity Program Manager at TransUnion [12]

Account Security Risks

When SMS verification is compromised, the fallout can be severe. A single SIM swap can trigger a chain reaction, jeopardizing multiple accounts at once. On average, victims face financial losses of around $45,000 [11], showing just how damaging these attacks can be.

A high-profile example of this occurred in 2018 when cryptocurrency investor Michael Terpin lost $23 million in a SIM swap attack. The attackers exploited weaknesses in carrier security, demonstrating how quickly they can take over valuable accounts.

So, what makes SMS verification so vulnerable? Several critical flaws stand out:

- Carrier Weaknesses: Mobile carriers often lack strong authentication protocols, making it easier for attackers to use social engineering to gain control [10].

- No Device Binding: SMS verification only ties codes to a phone number, not to a specific device, leaving a major gap in security [14].

- Slow Detection: Victims often don’t realize their accounts have been compromised until the damage is done. In fact, the FBI recorded 2,026 complaints about SIM swap attacks in 2022 alone [2].

The scale of the problem is growing. In 2023, the Internet Crime Complaint Center (IC3) reported over $48 million in losses from SIM swapping fraud. And with SMS traffic for authentication expected to make up more than 50% of all SMS usage by 2024, the risks tied to SMS verification are only increasing [13].

sbb-itb-070b8f8

Protecting Against SIM Swap Attacks

SIM swap attacks resulted in over $48 million in losses in 2023 [13], with an alarming success rate of around 80% [17]. Strengthening your defenses is crucial to avoid falling victim to this growing threat.

Better Authentication Methods

One of the best ways to guard against SIM swap attacks is to move away from traditional SMS-based verification. Here’s a breakdown of alternative authentication methods:

| Authentication Method | Security Level | Implementation Complexity |

|---|---|---|

| Authenticator Apps | High | Low |

| Hardware Security Keys | Very High | Medium |

| Biometric Verification | High | Medium |

| PIN-Protected SIM | Medium | Low |

Using multi-factor authentication (MFA) through authenticator apps is a smart first step [15]. Additionally, set unique PINs for both your wireless account and SIM card to add an extra layer of security [1].

"Wireless providers are working hard to prevent this type of fraud. As a consumer, you can play a critical role as well by taking steps to protect your wireless account." [1]

These methods, paired with detection tools, significantly reduce the risk of SIM swap attacks.

SIM Swap Detection Tools

Being able to spot the warning signs of a SIM swap attack is just as important as preventing one. Here are some red flags to watch for:

- Sudden loss of cellular service

- Alerts about unusual account activity

- Unauthorized password reset requests

- Login attempts from unfamiliar locations

Detection systems use advanced techniques like behavioral profiling and risk scoring. By analyzing location patterns and device fingerprints, these tools can help identify and stop potential threats [17].

Secure SMS Services

Since SMS verification has known vulnerabilities, secure SMS services can be a valuable line of defense. These services address the weaknesses of traditional SMS in several ways:

- Dedicated Number Protection: Using private, unshared phone numbers exclusively for MFA helps reduce exposure to SIM swap attacks [16].

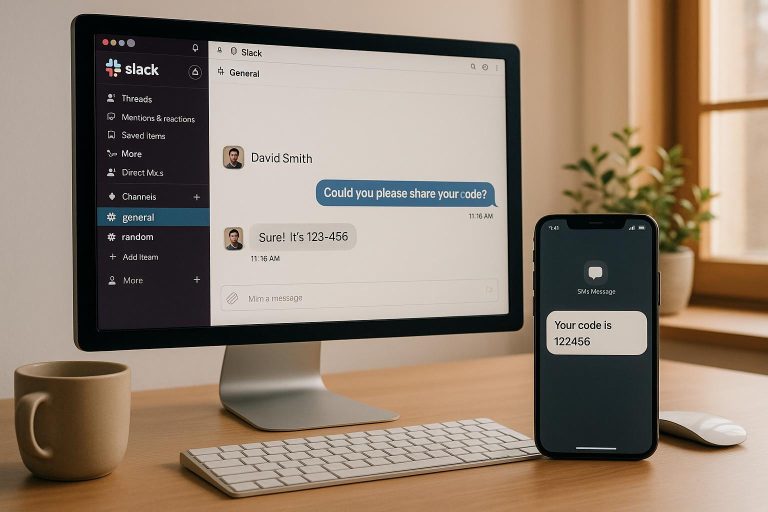

- Real-Time Monitoring: Services like JoltSMS provide instant alerts through dashboards and webhook integrations, allowing swift action against suspicious activities.

- Enhanced Privacy Features: Non-recycled phone numbers and carrier-grade SIM hardware offer stronger protection against unauthorized access.

"The best way to protect customers against these attacks is to adopt strategies that do not require an authentication associated with the actual phone number. OTP over SMS is particularly vulnerable, given that one-time passwords are now sent to the fraudster’s phone versus the legitimate user. In these cases, behavioral pattern-based approaches, for example, offer a much higher degree of security." [17]

To further safeguard your accounts, avoid sharing personal details on social media, use a separate email address for financial activities [1], and regularly review your account settings to ensure everything is secure [6].

JoltSMS Security Features

SIM swap attacks led to over $68 million in losses in 2021 alone [18]. For businesses, this underscores the urgency of securing SMS verification processes. JoltSMS steps up to this challenge with strong defenses designed to prevent unauthorized access.

Core JoltSMS Functions

JoltSMS relies on carrier-grade SIM hardware to deliver a 99.9% reliability rate while adhering to rigorous security standards. Here’s a breakdown of its key security features:

| Security Feature | Protection Provided |

|---|---|

| Real-time Monitoring | Instant webhook alerts to Slack or Discord for quick detection and response to threats |

| API Integration | Secure REST API with encrypted communication channels for safe data exchanges |

| Access Controls | Team-based permissions and authentication for enhanced account security |

| Delivery Verification | Automated checks to confirm successful code delivery |

| Hardware Security | Physical safeguards through carrier-grade SIM infrastructure |

Real-time monitoring ensures that verification codes are instantly forwarded to designated team channels, enabling immediate action if a threat arises. In addition to these advanced tools, JoltSMS takes security a step further with its dedicated number approach.

Dedicated Number Advantages

Every year, approximately 35 million U.S. phone numbers are recycled [19], posing serious security risks. JoltSMS mitigates these vulnerabilities with its dedicated number strategy:

- Exclusive Number Assignment: Each customer is assigned a private U.S. phone number that remains unshared during the rental period.

- Extended Number Retention: A minimum 30-day retention period minimizes the risks associated with rapid number recycling.

- No Recycled History: By using non-recycled numbers, JoltSMS eliminates the chance of receiving messages meant for previous owners.

- Verification Compatibility: These numbers are pre-tested to work seamlessly with over 1,000 platforms, including major services like Google, WhatsApp, and banking apps.

Conclusion

SIM swap fraud has become a serious challenge for SMS-based verification systems. According to FBI data, losses from this type of fraud skyrocketed from $12 million between 2018 and 2020 to a staggering $68 million in 2021 alone [4]. These alarming numbers highlight the urgent need for stronger SMS security measures.

To combat this threat, adopting layered defenses is key. This includes setting a SIM PIN, enabling number transfer protection with your mobile carrier, and switching to authenticator apps instead of relying on SMS for two-factor authentication (2FA). Cybersecurity expert Yaniv Masjedi emphasizes:

"The simplest way is to set a SIM PIN, enable number transfer protection with your carrier, and use an authenticator app instead of SMS for 2FA" [20]

On the business side, companies should invest in secure SMS verification services that utilize carrier-grade infrastructure. For instance, JoltSMS offers enhanced security by using non-recycled, dedicated numbers, which reduces risks linked to number recycling. Features like instant threat detection through webhook alerts and encrypted API channels further ensure safe data transmission.

FAQs

How can I protect myself from SIM swap fraud and secure my accounts?

To protect yourself from SIM swap fraud, start by adding a PIN or passcode to your mobile account. This simple step makes it harder for anyone to make unauthorized changes to your phone number. If you’re unsure whether this feature is active, reach out to your carrier for assistance.

For stronger security, consider using app-based authentication tools like Google Authenticator or Duo instead of relying on SMS for two-factor authentication (2FA). These apps generate codes that are independent of your phone number, significantly reducing the risk of exploitation by attackers.

Keep an eye out for phishing attempts and unusual phone activity, such as a sudden loss of service. These could be signs of a SIM swap in progress. Taking swift action in such cases can help limit the damage.

What is SIM swap fraud, and how does it affect SMS-based two-factor authentication (2FA)?

SIM swap fraud happens when someone hijacks your phone number by transferring it to a SIM card they control. Once they have your number, they can intercept SMS messages, including one-time passcodes (OTPs) used for two-factor authentication (2FA). This gives them a way to bypass your account security and potentially access sensitive data.

To better protect yourself, think about switching to safer 2FA methods like authenticator apps, hardware tokens, or passkeys. These alternatives are harder to intercept and offer stronger security for your accounts.

Why do mobile carriers struggle to stop SIM swap attacks, and how can they improve security?

Mobile carriers often struggle to stop SIM swap attacks because the process depends largely on customer service representatives. Attackers exploit social engineering tactics to pose as victims and persuade carriers to transfer a phone number to a new SIM card. This reliance on human interaction makes it tough to completely secure the system.

Carriers can improve security by using stricter identity verification methods, such as requiring a unique PIN or password before making account changes. Another effective measure is offering multi-factor authentication (MFA) options that don’t depend on SMS, like authentication apps. Additionally, educating customers about the risks of SIM swapping and promoting alternative verification methods can help minimize these vulnerabilities.